6 Tips to get you started as a Sole Trader

21st February 2022

Mindset: The Happiness Pie

10th March 2022What is business governance?

Good governance is about structuring, operating, and controlling a company with a view to achieving long-term strategic goals for shareholders, creditors, employees, customers, and suppliers.

The effect of good governance is the realisation of the company’s desired vision and purpose due to achieving the required results and outcomes operationally in the business.

Why is good governance so important?

At a base level, good governance allows a business to keep operating:

1. Shareholders continue to invest money and time.

2. Funders continue to fund the business.

3. Suppliers continue to supply and allow credit because they sense a stable business environment.

4. Regulators (if any) allow the company to continue, as compliance matters are being met.

5. Customers continue to support the business by buying from it.

6. Employees continue to have faith in the business and continue providing their services.

How big does a company need to be to benefit from a governance process?

We would argue that the majority of companies, even smaller ones, would benefit from more effective governance. After all, “A big business starts small” – Richard Branson.

When a business is small, governance tends towards ad-hoc and laid back. On the other hand, when a business is large, governance can tend towards overly bureaucratic and arrogant.

The best governance, for all sizes of business, involves:

- Everything that’s needed; nothing that’s not

- Intense professional will, with deep personal humility

- Consensus without ‘groupthink’

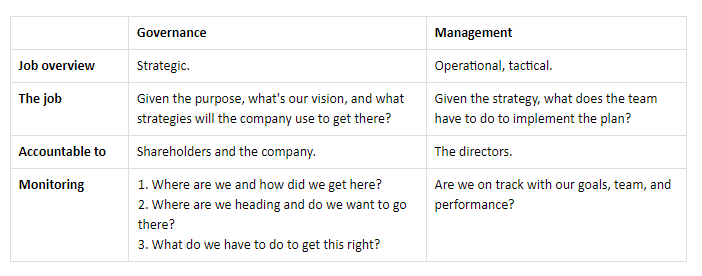

Governing versus managing a business

The four pillars of governance

1. Determination of purpose.

A value-adding Board leads the exploration and development of, and signs off on, a company’s purpose, its goals, and the strategy to achieve those goals.

2. Governance culture.

A value-adding Board works well as a team to deal effectively with the right issues at the right time and in the right manner. It operates within a high-performance culture that celebrates thoughtful challenge and dissent, commitment, candour, and trust.

3. Holding to account.

A value-adding Board holds management strictly and continuously to account through informed, astute, effective, and professional oversight. It does not do management’s job. Instead, it ensures the company’s purpose and strategy are understood by management and implemented according to a clear plan with proper resource deployment, task allocation, and performance management.

4. Compliance.

A value-adding Board ensures the company is, and remains, solvent. It ensures the reliance on financial reports and the accuracy of compliance. It also identifies and mitigates risk within the company.

The planning process

1. Determination of purpose.

A value-adding Board leads the exploration and development of, and signs off on, a company’s purpose, its goals, and the strategy to achieve those goals.

2. Governance culture.

A value-adding Board works well as a team to deal effectively with the right issues at the right time and in the right manner. It operates within a high-performance culture that celebrates thoughtful challenge and dissent, commitment, candour, and trust.

3. Holding to account.

A value-adding Board holds management strictly and continuously to account through informed, astute, effective, and professional oversight. It does not do management’s job. Instead, it ensures the company’s purpose and strategy are understood by management and implemented according to a clear plan with proper resource deployment, task allocation, and performance management.

4. Compliance.

A value-adding Board ensures the company is, and remains, solvent. It ensures the reliance on financial reports and the accuracy of compliance. It also identifies and mitigates risk within the company.

The planning process

There are many models and factors that a Board might consider.

1. Assess the environment the business operates within, including:

- Economic

- Demographic

- Technological

- Social

- Political and legal

- Ecological

2. Undertake a market review and competitor analysis:

A market review should include:

- Size, segment size, and growth rate

- Price sensitivity

- Service features

- Seasonability and demand distribution

- Supplier and customer price power

- Types of competition and entry to market cost

- Technology capability

- Intellectual capability

- Intellectual property capability

- Manufacturing process

- Innovation capability

A competitor analysis should include:

- The current known competitors, their objectives and strategies

- Potential new entrants and how they might differentiate

- Competitor strengths, unique propositions and their sustainability

- Weaknesses

3. Analyse performance and capability:

Analyse market positioning, including:

- In which market segments is the company strong?

- At what stage of the market life cycle are those segments?

- Is the company the leader in innovation (product or service)?

- To what extent can the company control its pricing?

- What core competencies does the company possess and are these sustainable?

Analyse financial positioning, including:

- What is the company’s cost of capital?

- What is the profile of free cashflow generation from core operating activities?

- What are the company’s forecast capital requirements?

- Is the asset backing adequate?

- Do exchange rate fluctuations impact the cost of sales or the value of exports?

- What expectations do shareholders have in terms of profit and dividends?

Analyse operational positioning, including:

- What is the company’s overall culture, morale and staff turnover?

- How connected is the team to the company’s purpose and strategy?

- What is the team’s capacity to adapt and change?

- What is the level of management capability throughout the organisation?

- What degree of obsolescence applies to the company’s plant, technology, and intellectual property?

4. Develop a company strategy.

There are a plethora of strategic planning models and templates a company could employ. Detail on the creation of a Strategic Plan is outside the scope of this guide, however, please get in touch with us if you need help to develop your Strategic Plan.

5. Setting company objectives.

With the company’s purpose understood, the Board needs to determine a Strategic Plan to implement that purpose. A Strategic Plan normally takes a medium view (5 years) of the business.

Smaller and less complex businesses need to have, at the very least, an annual Business Plan. The Business Plan will specify objectives over shorter periods, for example, a year or a quarter, against which results can be measured.

Objectives are often divided into three categories:

1. Recurring: These tend to be financial, marketing, or sales oriented.

2. Creative: These are required to strengthen the company’s longer-term position and profitability. For example, to develop new markets, to develop new products or services, or to increase penetration in existing markets.

3. Problem solving: For example, fixing poorly performing departments, fixing product defects, reducing exposure to major customers, achieving productivity gains, reducing overheads, or releasing cashflow.

The seven key governance capabilities

The seven key governance capabilities are skill sets that are built up over time, as governance is learned and improved on the job.

1. Understanding the company’s financials and Key Performance Indicators.

This isn’t a quick learning process for many directors. It starts with learning to understand and interpret financial reports. Then, if you have a desire to learn more, you’ll develop your skills to a point where you become much more confident in your decision making.

2. Understanding yourself and others.

Once again, this is a learned skill. Growing your awareness in this area helps with understanding key peoples’ strengths, as well as their motivators and stressors. This is vital to good governance.

3. Focused planning.

Developing the skill of focused planning enables us to spend our time on what really matters to the long term success of the company, rather than being distracted by the many urgent but unimportant activities that are insignificant or should be delegated. Focused planning ensures we keep coming back to executing the purpose of the business.

4. Directing, in service of others.

The fundamental purpose of a business is to create value for others. A great director demonstrates the “intense professional will with deep personal humility” leadership attributes, as described by Jim Collins in his book ‘Good to Great’.

5. Managing, to ensure performance outcomes.

A person with this attitude manages people by giving them outcomes to achieve, not tasks to do. That means being comfortable in taking the risk of letting others come up with the solution. This helps people to actively take responsibility.

6. Leading.

Leaders want to inspire teams with the purpose of the business. They connect everything to the purpose because they know that, without a clear purpose and vision, the people go their own way.

7. Teaching.

People with this aptitude are excited by the process of adult learning and by the potential they see in people.

How to make your Governance Framework simple

First, create a place (physical or electronic) to record how you do governance.

Start with a few simple items, such as:

1. Board Meeting standing agenda.

2. Schedule of Board Meeting dates.

3. List of reports the Board needs to be provided with in advance of each Board Meeting, including:

- Marketing and sales

- Financial

- CEO or Managing Director

Then, build out your Governance Framework as you go.

Governance is a mindset

Good governance isn’t so much about learning a set of rules and procedures; it’s about having a mindset that desires to have a well-governed business. And you need some practices and coaching to get you there.

You can read more of our Mindset series on the blog here.